You Need A Tax Free Retirement Account.

Learn how we can set you and your loved ones up for success. Leverage the power of compound interest, protected growth tied to the market and tax-free access to your own money.

0-1%

Floor. Never lose your principal. Even if the market tanks your account won't.

-65+

You choose when you want to retire. Design your retirement plan

48%

of Americans do not have death, disability or critical illness insurance coverage

SERVICES

Our Expertise and Key Service Areas

Million Dollar Baby

Set up a Million Dollar Baby account for your children giving them a powerful head start. This account builds cash value that can be utilized for various purposes such as education expenses, a down payment on a home, or supplementing retirement savings.

Retirement

Want a tax-smart retirement plan?

Tax-Free Retirement Accounts can have significant benefits for retirement. The cash value inside a TFRA grows tax-deferred, and you can borrow against it without paying capital gains tax. Use it to create a robust retirement income stream.

Legacy & Protection

A Tax- Free retirement plan provides the death benefit protection you need with cash value growth potential. It also gives you the option to access your death benefit early in the event of a qualifying chronic, critical, or terminal illness.

Tax Deferred Account

(401k, IRA, TSP, 403b)

You will be required to pay taxes in the future once you access your retirement account

Your money is not liquid, you may not withdraw before a triggering event, or you will be penalized

Earnings are reported to IRS, you have a lifelong partner that will enjoy your retirement account with you he is call "Uncle Sam."

Your account will reflect market performance. While it may enjoy some market high's it can also drop, heavily impacting your savings.

Tax Free Retirement Account

Access to money in your account. Use it when you need it without penalty.

Access your retirement funds tax free.

Lock in gains, not the losses. Stay protected from market volatility.

Added layer of protection with a life insurance component. Covers you in case of death, disability or critical illness.

Versatile use. College planning, legacy planning and retirement planning. Set your entire family up with a secure future when it comes to finances.

BUILD A COMPOUND INTEREST TAX FREE RETIREMENT

Why Hasn't My Financial Advisor Ever Told Me About This?

Most financial advisors do not know that you can legally set up a tax-free account utilizing IRS code 7702. Advisors usually do not have the additional license needed to apply for these types of compound interest accounts. As an insurance brokerage we offer products that have unique benefits.

Financial advisors recommend or promote products that they contract with only, or the products that their company promotes. As a broker we have over 50+ carrier partners to find you the most competitive product in the market that matches your need.

Financial advisors are paid in fees from the accounts they set up (IRA's, 401k etc.). This is how they make their commissions. Most likely clients are not seeking tax free strategies because they do not know other options exist. Until recent times tax-free savings vehicles were only utilized by wealthy individuals. Shocking, right?

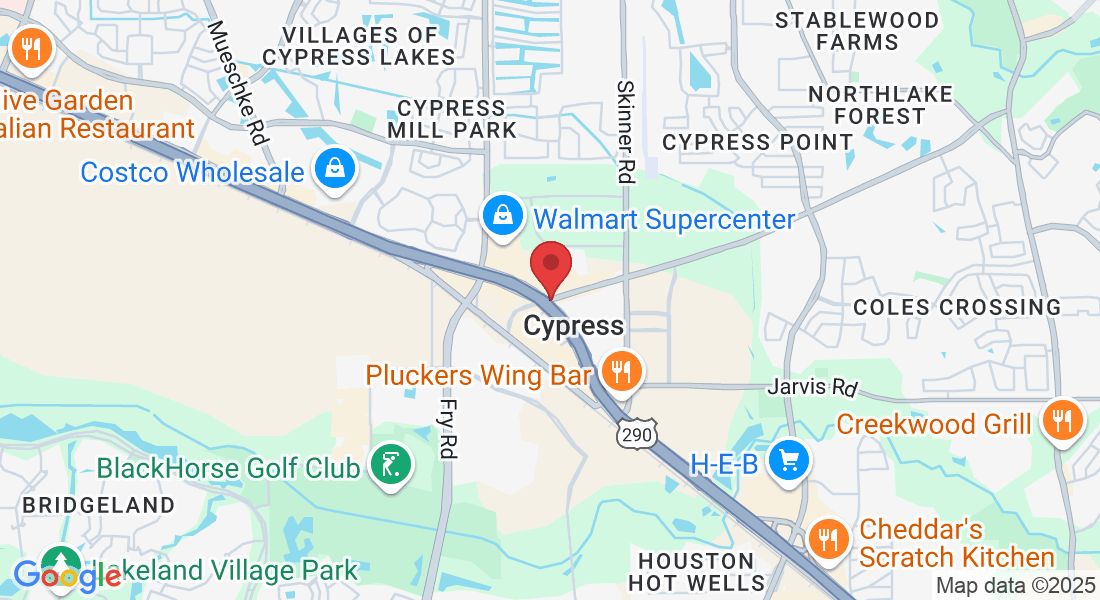

Email: [email protected]

Get In Touch

Assistance Hours

Mon – Fri 9:00am – 4:30pm

Saturday 10:00am-3:00pm

Sunday – CLOSED

Phone Number:

281-730-6442

Facebook

Instagram

Youtube

TikTok